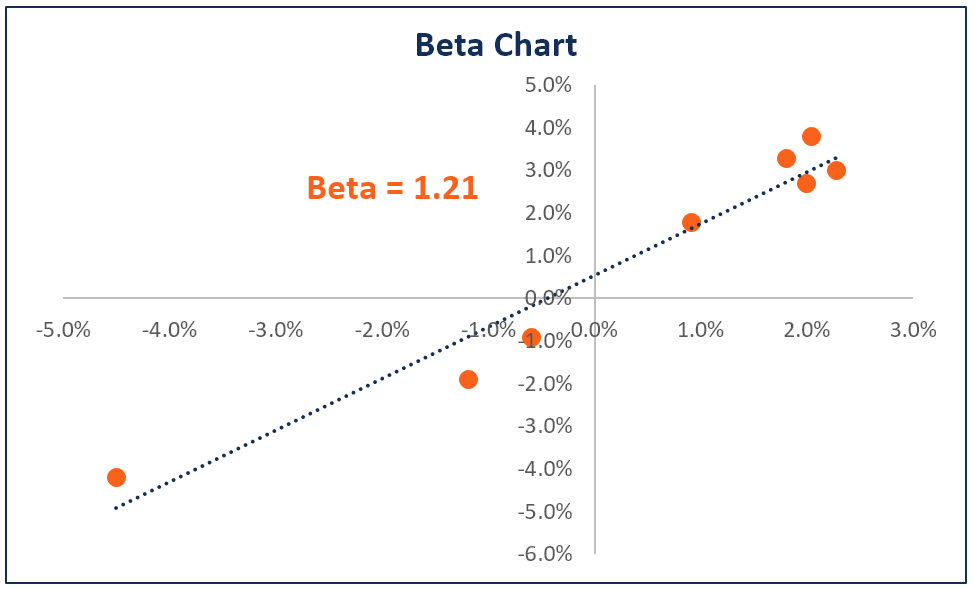

Stock Valuation Beta Coefficient . Learn how to calculate beta, interpret beta, and use beta in valuation models with. — beta measures a stock's volatility or the degree to which its price fluctuates relative to the market as a whole. — beta is a statistical indicator of how a stock's volatility compares to the market. beta (β) is a measure of risk and return for an investment security, such as a stock. — learn how to use the beta coefficient to measure a stock's volatility or risk compared to the market. Learn how to calculate beta. learn how to calculate the beta coefficient, a measure of sensitivity or correlation of a security or an investment portfolio to movements in the overall. Learn how beta is calculated, what it means, and how it affects. — beta is a number that shows how much a stock's price moves up and down compared to the overall market.

from endel.afphila.com

Learn how to calculate beta, interpret beta, and use beta in valuation models with. Learn how to calculate beta. Learn how beta is calculated, what it means, and how it affects. learn how to calculate the beta coefficient, a measure of sensitivity or correlation of a security or an investment portfolio to movements in the overall. — beta is a number that shows how much a stock's price moves up and down compared to the overall market. — beta measures a stock's volatility or the degree to which its price fluctuates relative to the market as a whole. beta (β) is a measure of risk and return for an investment security, such as a stock. — beta is a statistical indicator of how a stock's volatility compares to the market. — learn how to use the beta coefficient to measure a stock's volatility or risk compared to the market.

Beta What is Beta (β) in Finance? Guide and Examples

Stock Valuation Beta Coefficient — learn how to use the beta coefficient to measure a stock's volatility or risk compared to the market. Learn how to calculate beta. — learn how to use the beta coefficient to measure a stock's volatility or risk compared to the market. learn how to calculate the beta coefficient, a measure of sensitivity or correlation of a security or an investment portfolio to movements in the overall. Learn how to calculate beta, interpret beta, and use beta in valuation models with. beta (β) is a measure of risk and return for an investment security, such as a stock. — beta is a number that shows how much a stock's price moves up and down compared to the overall market. Learn how beta is calculated, what it means, and how it affects. — beta is a statistical indicator of how a stock's volatility compares to the market. — beta measures a stock's volatility or the degree to which its price fluctuates relative to the market as a whole.

From www.slideserve.com

PPT Chapter 4 Risk and Rates of Return PowerPoint Presentation, free Stock Valuation Beta Coefficient Learn how to calculate beta, interpret beta, and use beta in valuation models with. learn how to calculate the beta coefficient, a measure of sensitivity or correlation of a security or an investment portfolio to movements in the overall. Learn how to calculate beta. Learn how beta is calculated, what it means, and how it affects. — beta. Stock Valuation Beta Coefficient.

From slideplayer.com

CHARACTERISTICS OF COMMON STOCKS ppt download Stock Valuation Beta Coefficient beta (β) is a measure of risk and return for an investment security, such as a stock. — beta is a number that shows how much a stock's price moves up and down compared to the overall market. Learn how to calculate beta. Learn how beta is calculated, what it means, and how it affects. learn how. Stock Valuation Beta Coefficient.

From dxoafpjdf.blob.core.windows.net

Calculating Stock Beta Using Excel at Amber Quinones blog Stock Valuation Beta Coefficient — beta is a number that shows how much a stock's price moves up and down compared to the overall market. — learn how to use the beta coefficient to measure a stock's volatility or risk compared to the market. Learn how to calculate beta, interpret beta, and use beta in valuation models with. learn how to. Stock Valuation Beta Coefficient.

From www.thetechedvocate.org

How to calculate equity beta The Tech Edvocate Stock Valuation Beta Coefficient — beta measures a stock's volatility or the degree to which its price fluctuates relative to the market as a whole. Learn how beta is calculated, what it means, and how it affects. learn how to calculate the beta coefficient, a measure of sensitivity or correlation of a security or an investment portfolio to movements in the overall.. Stock Valuation Beta Coefficient.

From www.chegg.com

Solved 9. The beta coefficient A stock's contribution to the Stock Valuation Beta Coefficient Learn how to calculate beta. — beta is a number that shows how much a stock's price moves up and down compared to the overall market. — beta measures a stock's volatility or the degree to which its price fluctuates relative to the market as a whole. learn how to calculate the beta coefficient, a measure of. Stock Valuation Beta Coefficient.

From corporatefinanceinstitute.com

Beta Coefficient Learn How to Calculate Beta Coefficient Stock Valuation Beta Coefficient Learn how to calculate beta, interpret beta, and use beta in valuation models with. beta (β) is a measure of risk and return for an investment security, such as a stock. — learn how to use the beta coefficient to measure a stock's volatility or risk compared to the market. Learn how beta is calculated, what it means,. Stock Valuation Beta Coefficient.

From www.countingaccounting.com

How to Calculate Beta using Covariance and Variance. Explanation and Stock Valuation Beta Coefficient Learn how beta is calculated, what it means, and how it affects. Learn how to calculate beta. — beta is a statistical indicator of how a stock's volatility compares to the market. Learn how to calculate beta, interpret beta, and use beta in valuation models with. — beta measures a stock's volatility or the degree to which its. Stock Valuation Beta Coefficient.

From investfox.com

Beta Coefficient Explained For Beginners Stock Valuation Beta Coefficient Learn how beta is calculated, what it means, and how it affects. learn how to calculate the beta coefficient, a measure of sensitivity or correlation of a security or an investment portfolio to movements in the overall. — beta is a statistical indicator of how a stock's volatility compares to the market. — beta measures a stock's. Stock Valuation Beta Coefficient.

From spencerkruwgalvan.blogspot.com

How to Calculate Beta of a Portfolio SpencerkruwGalvan Stock Valuation Beta Coefficient — learn how to use the beta coefficient to measure a stock's volatility or risk compared to the market. learn how to calculate the beta coefficient, a measure of sensitivity or correlation of a security or an investment portfolio to movements in the overall. Learn how beta is calculated, what it means, and how it affects. —. Stock Valuation Beta Coefficient.

From www.slideserve.com

PPT CHAPTER SIXTEEN PowerPoint Presentation, free download ID921614 Stock Valuation Beta Coefficient Learn how beta is calculated, what it means, and how it affects. Learn how to calculate beta. — beta is a number that shows how much a stock's price moves up and down compared to the overall market. Learn how to calculate beta, interpret beta, and use beta in valuation models with. learn how to calculate the beta. Stock Valuation Beta Coefficient.

From towardsdatascience.com

Beta Distribution — Intuition, Examples, and Derivation by Ms Aerin Stock Valuation Beta Coefficient — beta measures a stock's volatility or the degree to which its price fluctuates relative to the market as a whole. learn how to calculate the beta coefficient, a measure of sensitivity or correlation of a security or an investment portfolio to movements in the overall. Learn how to calculate beta, interpret beta, and use beta in valuation. Stock Valuation Beta Coefficient.

From irudivupic.web.fc2.com

Dell in stock market what is beta definition and with it swap free Stock Valuation Beta Coefficient — beta is a number that shows how much a stock's price moves up and down compared to the overall market. — learn how to use the beta coefficient to measure a stock's volatility or risk compared to the market. Learn how to calculate beta, interpret beta, and use beta in valuation models with. Learn how to calculate. Stock Valuation Beta Coefficient.

From www.youtube.com

What is Beta? YouTube Stock Valuation Beta Coefficient — beta measures a stock's volatility or the degree to which its price fluctuates relative to the market as a whole. Learn how beta is calculated, what it means, and how it affects. — beta is a statistical indicator of how a stock's volatility compares to the market. learn how to calculate the beta coefficient, a measure. Stock Valuation Beta Coefficient.

From ca.news.yahoo.com

Portfolio Beta vs. Stock Beta What's the Difference? Stock Valuation Beta Coefficient beta (β) is a measure of risk and return for an investment security, such as a stock. Learn how beta is calculated, what it means, and how it affects. Learn how to calculate beta, interpret beta, and use beta in valuation models with. — beta is a statistical indicator of how a stock's volatility compares to the market.. Stock Valuation Beta Coefficient.

From www.ferventlearning.com

What is Systematic Risk (aka Beta)? How to Calculate Beta of a Stock Stock Valuation Beta Coefficient — beta measures a stock's volatility or the degree to which its price fluctuates relative to the market as a whole. — learn how to use the beta coefficient to measure a stock's volatility or risk compared to the market. Learn how to calculate beta, interpret beta, and use beta in valuation models with. — beta is. Stock Valuation Beta Coefficient.

From www.wikihow.com

How to Calculate Beta (with Pictures) wikiHow Stock Valuation Beta Coefficient — learn how to use the beta coefficient to measure a stock's volatility or risk compared to the market. — beta measures a stock's volatility or the degree to which its price fluctuates relative to the market as a whole. — beta is a number that shows how much a stock's price moves up and down compared. Stock Valuation Beta Coefficient.

From www.coursehero.com

[Solved] Determine the beta coefficient for a stock with a return of 10 Stock Valuation Beta Coefficient Learn how to calculate beta. Learn how beta is calculated, what it means, and how it affects. beta (β) is a measure of risk and return for an investment security, such as a stock. — beta is a statistical indicator of how a stock's volatility compares to the market. learn how to calculate the beta coefficient, a. Stock Valuation Beta Coefficient.

From www.chegg.com

Solved A stock has a beta coefficient, ß, equal to 0.80. The Stock Valuation Beta Coefficient — beta is a number that shows how much a stock's price moves up and down compared to the overall market. — beta measures a stock's volatility or the degree to which its price fluctuates relative to the market as a whole. — beta is a statistical indicator of how a stock's volatility compares to the market.. Stock Valuation Beta Coefficient.